idaho estate tax return

Call us today and let our experts guide you through all of your will and trust questions. If an estate is large enough Form 706 the United States Estate Tax Return is due to the IRS within nine months of the death of the deceased with a 6-month extension permitted.

How To File Taxes For Free In 2022 Money

Also you are required to file an estate tax return if the estate had more than 600 in income during the year.

. A federal estate income tax return IRS Form 1041 for income received by the estate may be required for each year in which the gross income exceeds a certain level. Due Date Individual Returns April 15 or same as IRS. Your Adjusted Gross Income is between 9500 and 72000 and your age is 65 or younger.

At 5901 providing that provisions of Section 121d9 will not apply to estates or decedents dying after December 31 2010. A homeowner with the same home value of 250000 in Twin Falls Twin Falls County would be. You would need TurboTax business to prepare the estate tax return.

Letter to IRS requesting prompt audit of estate tax return 347 31. If the estate is complicated at all you. It takes about three weeks to enter new filers into our system.

Payment of any additional tax due together with any applicable interest and penalty must accompany the Idaho return. A homeowner with a property in Boise worth 250000 would then pay 2003 for their annual property taxes. The individual federal estate tax exemption is 117 million for 2021 so an estate smaller than 117 million may not be faced with estate taxes unless the deceased individual made substantial.

This article goes over topics that include probate how to successfully create a valid will in Idaho and what happens to your property if you die without a. Sarah FisherMar 03 2020. General Tax Return Information.

A return shall be required to be filed with the Commission by every estate that is required by the laws of the United States to file a federal estate tax return. Understand typical refund time frames. Nobody wants to hear from theIRS âand I mean nobody.

File your Idaho income tax return on or before the 15th day of the fourth month following the close of your tax year. We must manually enter information from paper returns into our database. Do not enter the total net or taxable estate from line 3 page 1 nor the total from line 5 page 1 which includes taxable gifts.

Which is never good news. You can check the status of your Idaho state tax refund online at the Idaho State Tax Commission website. Enter the total of Idaho distributable income from Form PTE-12 columns b c and e.

Please contact the Estate Tax Section Illinois Attorney Generals Office with any questions or problems. Line 5 Income Distribution Deduction Enter the amount of the deduction for distributions to beneficiaries. To put this into perspective a home in Boise Idaho Ada County has a property tax rate of 801.

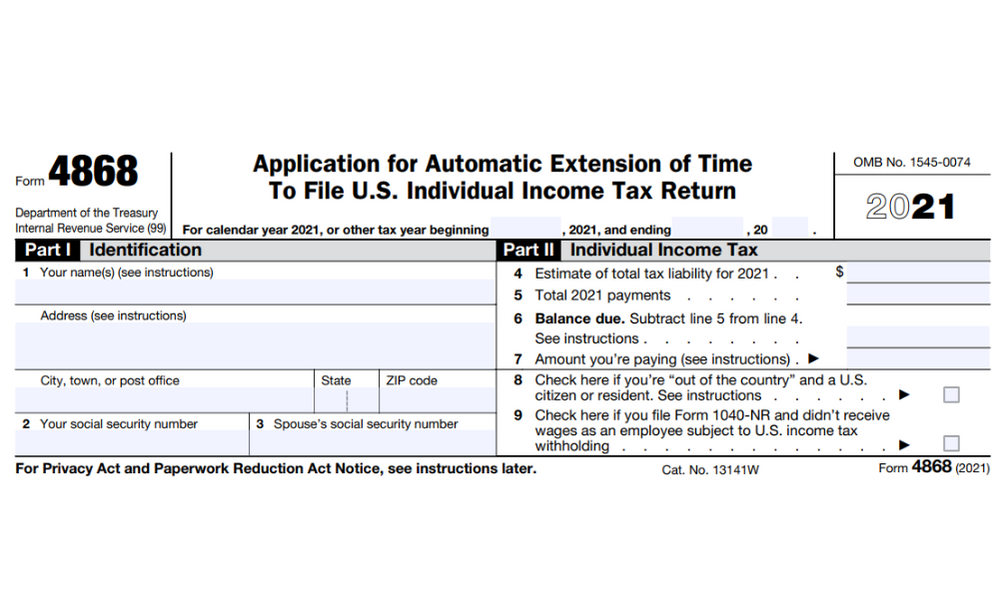

7 rows Idaho might require an Idaho individual income tax return Form 40 or Form 43 for the last. Extensions To receive an automatic six-month extension the taxpayer needs to pay either an estimate of 80 percent of the current year tax liability or 100 percent of what the taxpayer paid for state income taxes the previous yearIf the taxpayer needs to make a. If your estate is large enough you still may have to worry about the federal estate tax though.

However like all other states it has its own inheritance laws including the ones that cover what happens if the decedent dies without a valid will. You can expect your refund about 10 to 11 weeks after we receive your return. Find IRS or Federal Tax Return deadline details.

The final Idaho return for the trust or estate. Ad Instant Download and Complete your Probate Forms Start Now. County tax rates range throughout the state.

An estates tax ID number is called an employer identification number or EIN and comes in the format 12-345678X. Idaho has no state inheritance or estate tax. Idaho has no estate tax.

You can prepare and e-file your IRS and Idaho State Tax Return eg resident nonresident or part-year resident returns now. Treasure Valley Concerned Over Rise in IRS Estate Tax Audits. Before filing Form 1041 you will need to obtain a tax ID number for the estate.

Ad Client focused law firm. The decedent and their estate are separate taxable entities. This requirement extends to nonresident estates which have property interests with situs within Idaho included in the federal estate gross value.

There is an 1170 million million exemption for the federal estate tax for deaths in 2021 increasing to 1206 million in 2022. Select Popular Legal Forms Packages of Any Category. But auditsare not just for your income tax returns either â they also apply to estate taxreturnsEstate tax return audits can.

The Idaho tax filing and tax payment deadline is April 18 2022. Include Form PTE-12 with the return if the trust or estate files as a pass-through entity. Fiduciary - An automatic six-month extension of time to file is granted until 6 months after the original due date of the return.

Idaho Estate and Transfer Tax Return must immediately be filed along with a copy of the amended Federal Estate Tax Return. An Idaho return Form 66 for income received by the estate may also be required for each year for which a federal return is filed. 1 1 143 Reply.

Written notice of any changes in the federal estate tax liability must be submitted to the Idaho State Tax Commission along. You can apply online for this number. Idaho State Tax Commission Estate Tax PO Box 36 Boise ID 83722-0410 1.

Letter to Internal Revenue Service transmitting Federal Estate 346 Tax Return 30. Letter to Internal Revenue Service transmitting Federal Fiduciary 348 Income Tax Return 32. In the Boise area call 208 364-7389.

Youre on active duty military with an Adjusted Gross Income under 72000. Object Moved This document may be found here. Letter to Idaho State Tax Commission transmitting Tentative Idaho 345 Transfer and Inheritance Tax Return 29.

If the Idaho Fiduciary Income Tax Return Form 66 is filed within the automatic extension period but less than 80 of the current year tax liability or 100 of the total tax paid last year was paid by the original due date an extension penalty will apply. Enter the total gross estate from line 1 page 1 of the Federal Form 706. You can expect to receive your refund in about seven weeks from the date you receive your state acknowledgement.

Practice exclusive to wills trusts and probate law. You can expect your refund about seven to eight weeks after you receive an acknowledgment that we have your return. Be aware that the IRS and the respective State Tax Agencies require you to e-file a Federal Income Tax Return at the same time you e.

A full copy of the federal estate tax return form 706 must be filed with this return. 100 West Randolph Street. The information from the federal estate tax return must be used to complete the state estate tax return.

13 April 2013 Author. All Major Categories Covered. Call the toll-free automated refund information number.

Tax Form Filling Thetax Form Standard Us Income Tax Return Ad Filling Form Tax Thetax Return Ad Tax Forms Home Equity Debt Consolidation

2022 No Tax Return Mortgage Options Easy Approval

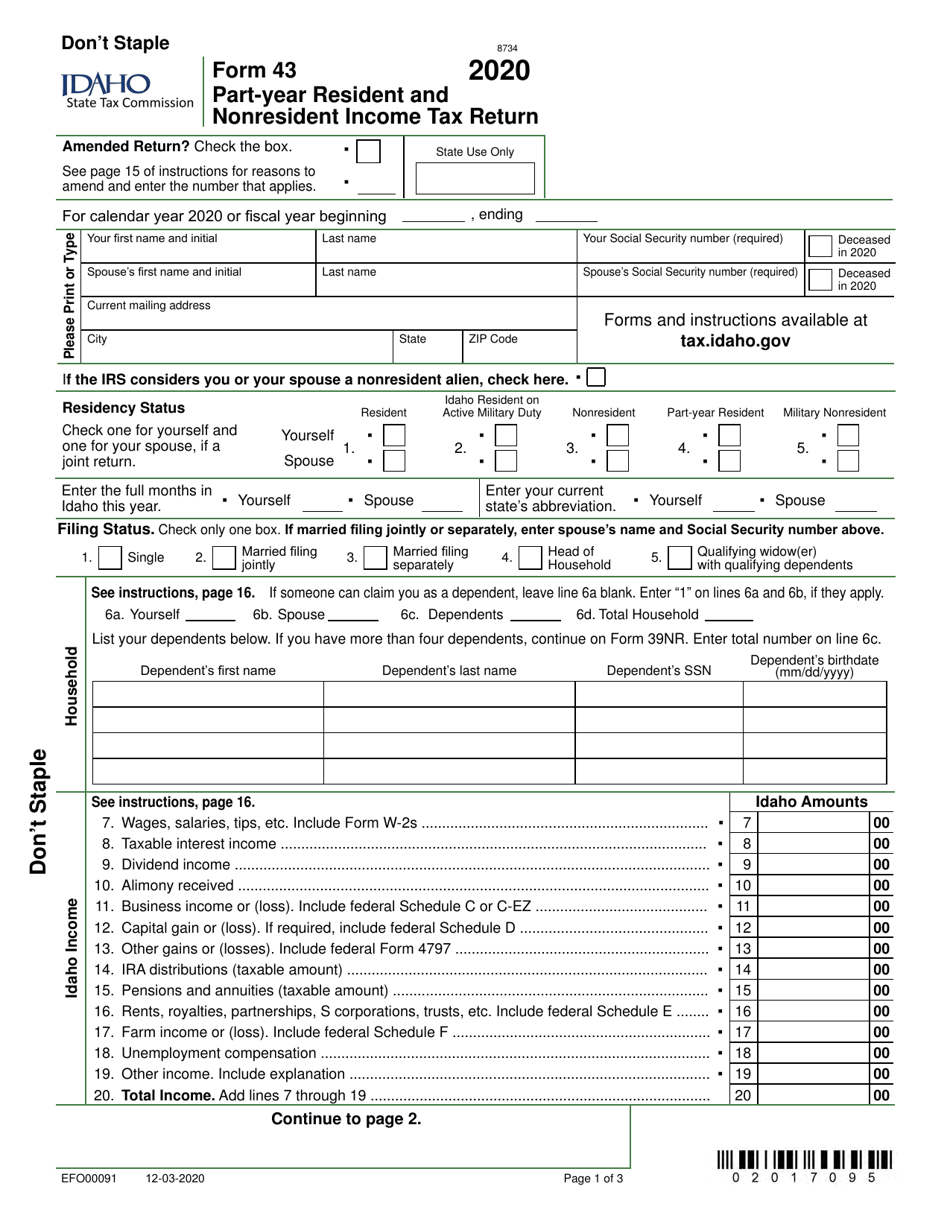

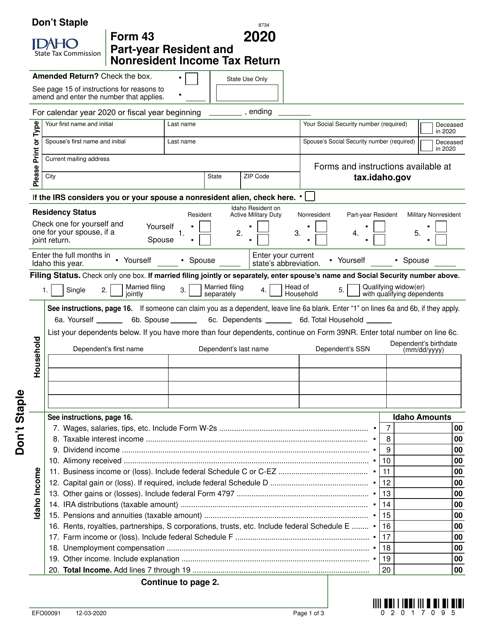

Form 43 Efo00091 Download Fillable Pdf Or Fill Online Part Year Resident And Nonresident Income Tax Return 2020 Idaho Templateroller

Filing An Idaho State Tax Return Things To Know Credit Karma Tax

Tax Refunds In America And Their Hidden Cost 2020 Edition

You Made A Mistake On Your Tax Return Now What

Why Delivering Government It Projects Can Be So Taxing

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

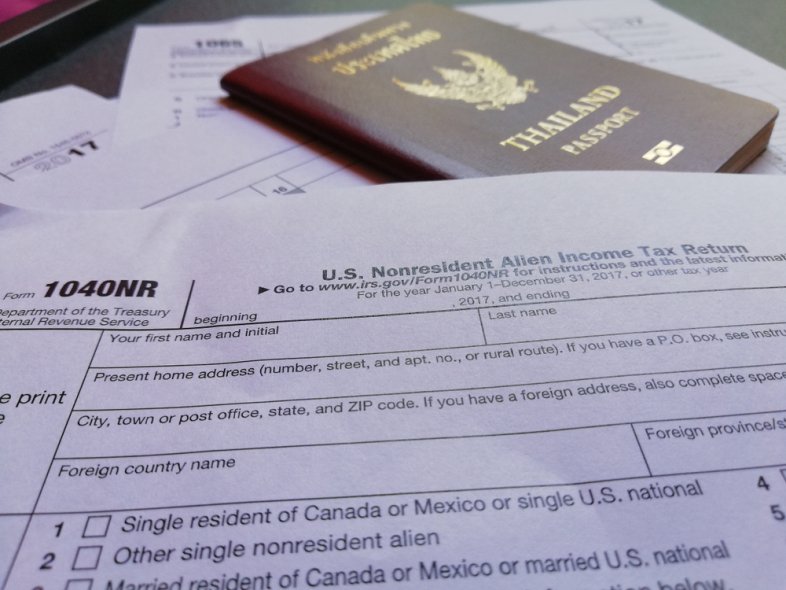

What Non U S Citizens Should Know About Filing Taxes Mybanktracker

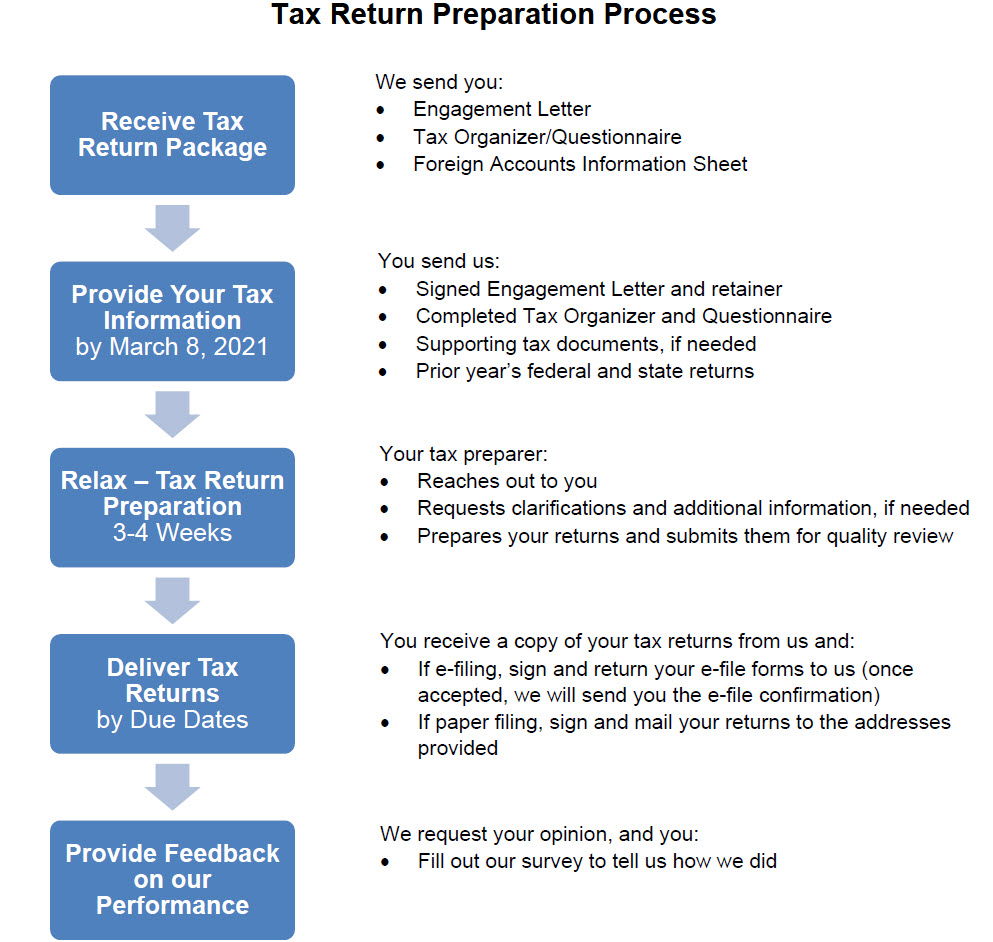

Tax Return Information The Wolf Group

Banking Suvidha Income Tax Return Itr Pan Aadhaar Tax Saving F Personal Injury Lawyer Injury Lawyer Estate Planning Attorney

How Your Idaho Income Tax Refund Can Process Faster Tax Refund Tax Help Income Tax

Idaho State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller

Will The Irs Extend The Tax Deadline In 2022 Marca

Understanding The 1065 Form Scalefactor

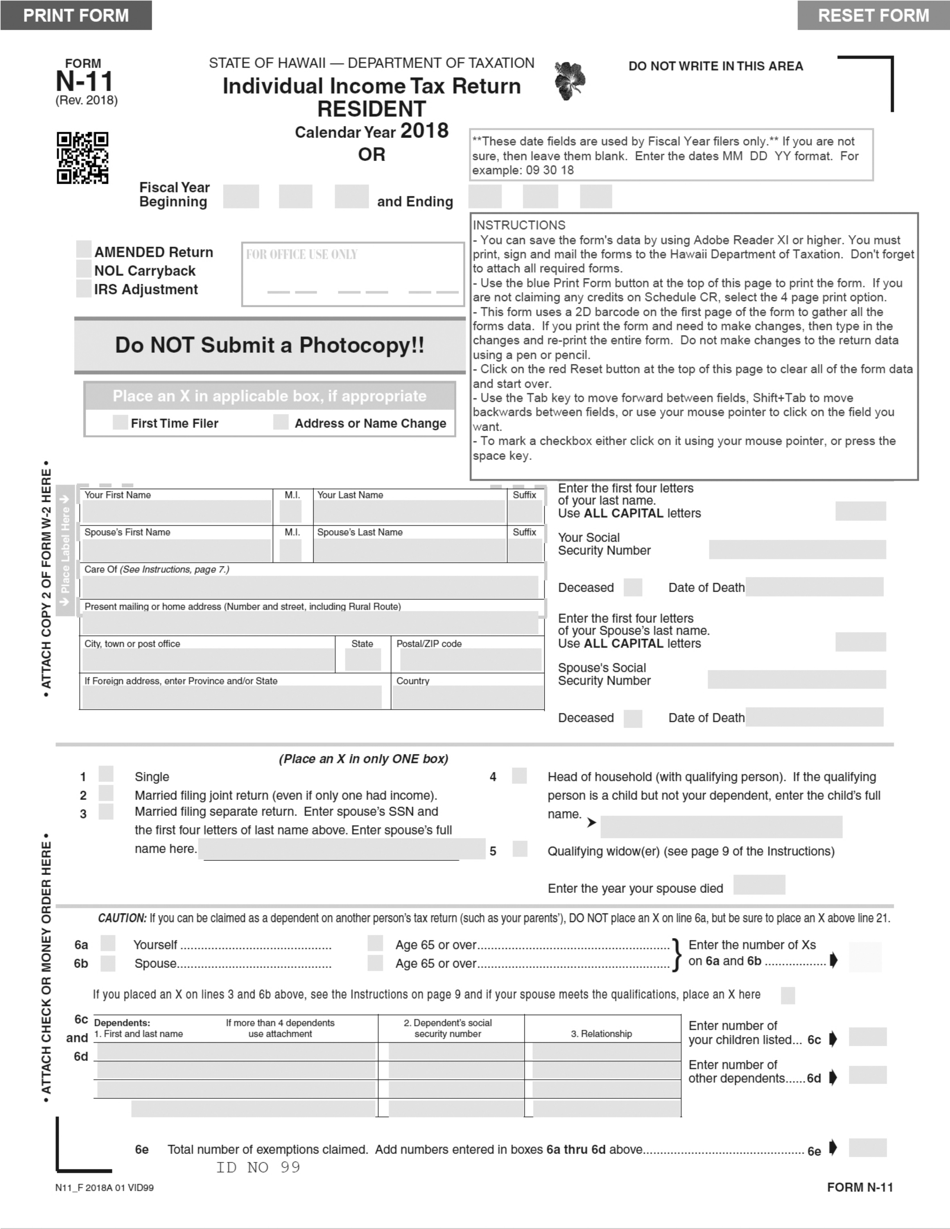

Form N 11 Download Fillable Pdf Or Fill Online Individual Income Tax Return Resident 2018 Hawaii Templateroller